We established Promontory Point Capital in 2004 as an investment banking firm focused on providing business and transactional advisory services to Midwest-based privately-held, many of which are family-held, businesses. Both of us grew up in the banking industry, and as such, we have had clients from a diverse set of industries encompassing manufacturers; companies involved in business services, technology, and software; as well as distribution companies throughout the upper Midwest. Over time, our firm’s reputation has taken us beyond Wisconsin and Illinois, but as you can see from our client map, many of our past clients are either fans of the Packers or the Bears.

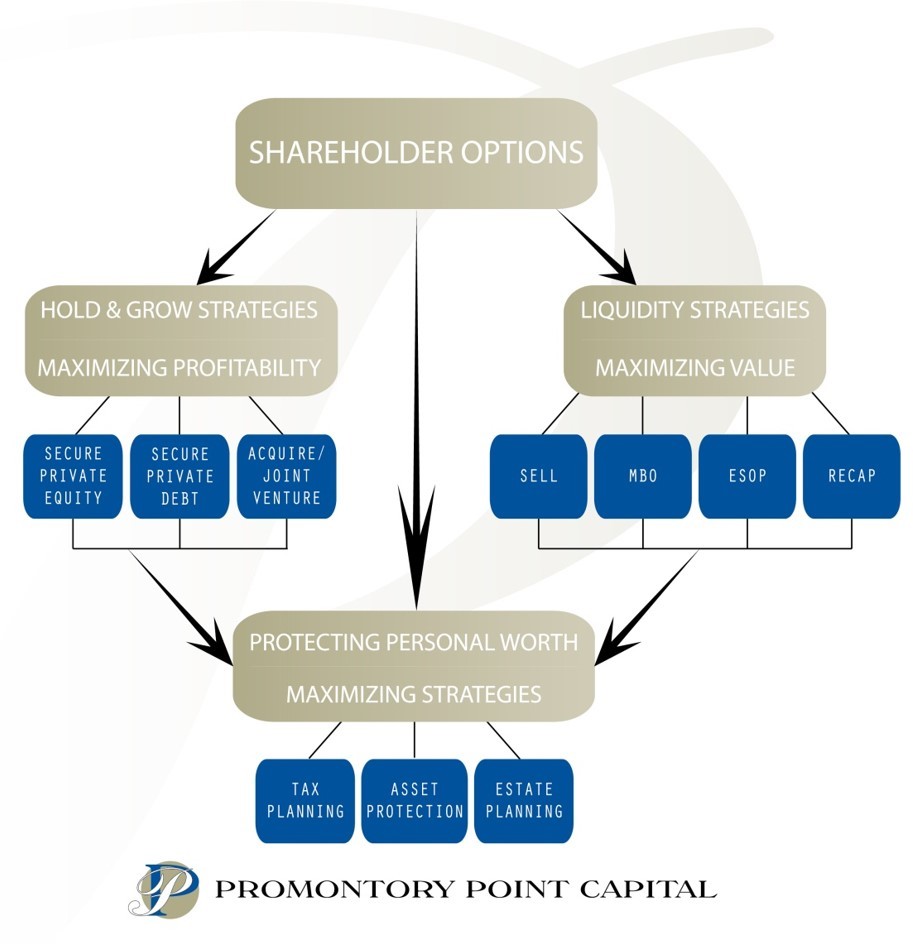

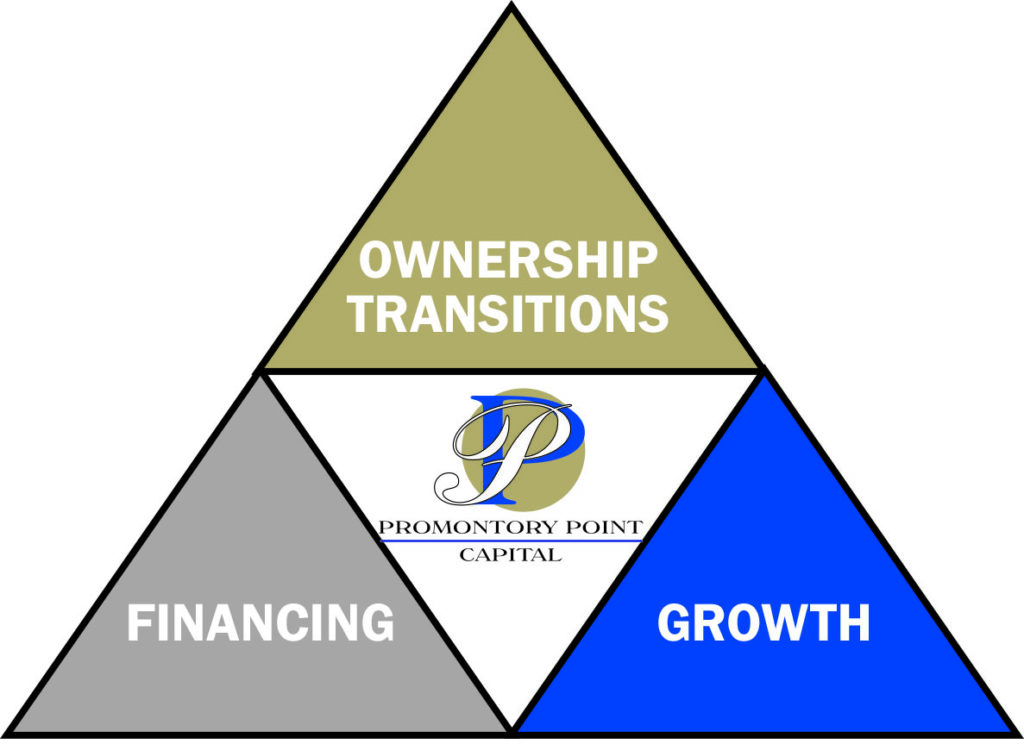

Our firm’s expertise is unique in the marketplace and our experience complements a client’s existing team of outside advisors which usually includes a business attorney, an outside CPA firm, and a commercial lender. Our initial role is to listen and to understand your goals and objectives, followed by executing a plan of action designed to deliver options that address these objectives. Whether your goal is to grow by acquisition, attract financing, or explore the sale of all or a portion of your business, we lead an engagement that delivers alternatives that result in satisfying outcomes for our clients.

Frequently, Promontory Point Capital is introduced to a company owner or CEO by a law firm, accounting firm, commercial lender, or another trusted business advisor where shareholders and/or management desire to better understand their strategic or financial options for financing, growth, shareholder liquidity, or achieving other goals. In any given year, our firm may be introduced to 50 or more different companies as some business owners have immediate needs, while many others are planning for events over a longer, multi-year horizon.

Since being established, Promontory Point Capital has successfully led more than 175 client engagements involving a wide variety of shareholder goals including ownership transition, ownership liquidity, strategic acquisition, and financing objectives. We invite business owners and C-Level executives that may wish to have an introductory conversation to give us a call. Please also check out the other areas of our website including our Done Deals section as well as what our clients have said about their experience with our firm.

We look forward to your confidential inquiry.

Chris Riegg

Partner & Co-Founder

Bill Penkwitz

Partner and Co-Founder

What our clients say

“I highly recommend to business owners and CEO’s to always use a competent advisor such as Promontory when raising capital or engaging in M&A activity. Your team is well suited for both and will undoubtedly serve others well …”

Matt Boettner

President and CEO, ASG

“Working with PPC was a pleasure.Your firm played a key role in helping Pierce Engineers Inc. plan and navigate our internal transition plan from senior ownership to new ownership within our firm for years to come.You were both hands on in our discussions and process and presented us with many options to consider along our path to transition.”

Randy Elliott

President, Pierce Engineers, Inc.

“Through the process, PPC and Bill Penkwitz, its lead partner on the deal, provided outstanding guidance; exceptional understanding and management of the process; consistent, clear and fast-response communications with all parties; and a great sensitivity to hitting transaction milestones …”

Tom Magulski

Titan, Inc

Ready to Talk?

PPC brings deep financial and strategic expertise to the table along with a fresh perspective from the outside market. Please contact us to discuss your objectives.